Protecting Your Online Business: 4 Financial Risks Every Online Seller Must Address

Protecting Your Online Business: 4 Financial Risks Every Online Seller Must Address

Running an online business (when compared to a physical store) comes with a multitude of financial advantages such as a global reach, extended operational hours, and lesser overhead. However, just because there are potentially more financial opportunities owning a virtual business doesn’t mean online sellers aren’t susceptible to making really poor business decisions that could impede their financial growth.

From inadequate insurance coverage to poor budgeting practices to limited revenue streams, this blog will delve into four of the most common financial risks eCommerce businesses face and advise on how to navigate such hurdles in effective ways. Understanding the potential consequences and implementing appropriate strategies will empower you to navigate the complex landscape of online business with confidence.

Remember, securing the financial health of your online business is not just about profitability; it’s also about mitigating potential setbacks and ensuring long-term sustainability.

1. Inadequate Budgeting and Cash Flow Management

This one is probably a no-brainer. However, it’s astounding how many entrepreneurs have great ideas, but lack the ability to manage their finances.

To state the obvious: Effective budgeting and cash flow management are paramount if you want to run a successful online store. By forecasting revenue and expenses (which we understand isn’t always easy), you can prioritize investments that will drive growth to your business, while scaling back funds toward areas of your business that may not need it as much. (Note: As you will read later, this does not include evading business insurance.)

Cash flow management, on the other hand, ensures that you have enough liquidity to meet your financial obligations and seize opportunities. It involves monitoring your incoming and outgoing cash, identifying patterns, and optimizing your working capital. Budgeting and cash flow management are equally important, and if you haven’t started your eCommerce journey yet, we highly recommend you take some business finance courses first.

eCommerce businesses often stumble due to common mistakes and oversights that undermine their financial stability. This often occurs before their business has even been launched. Where excited new sellers usually mess up is remembering to budget for the creation of their business, but not for the running of their business.

Let’s take Amazon for example. According to a survey conducted by JungleScout, new Amazon sellers spend (on average) between $2,000 - $4,000 to start their Amazon journey. On the surface, this sounds like a great deal! Plenty of people have that kind of money to invest in a business.

But if you keep reading that same survey, it states that the majority of Amazon businesses take about a year to start earning profits. Where is all the money going in the meantime?

- PPC & advertising

- Amazon and FBA fees

- Supply chain operations

- Inspections

- Internal operations

- Software tools

The list goes on and on. Our point? If you are still in the initial stages of creating your company, do extensive research on the operational and marketing costs of maintaining your online business. Online selling is easy to start; it’s not-so-easy to continue.

But let’s say your eCommerce venture has already launched and you are right in the thick of your business. Here are the prevalent mistakes we often see with newer sellers:

- Inconsistent Tracking: If you are inadequately tracking your expenses, sales, and cash flow, you can’t make accurate and up-to-date financial decisions concerning your business and products.

- Overestimating revenue: By doing this, you create unrealistic expectations for your business and a potential strain on your cash flow. Always use conservative projections.

- No Emergency Funds: Failing to set aside funds for emergencies or economic downturns leaves your business vulnerable to unexpected expenses. This can disrupt your operations, and even lead to the loss of your business.

- Poor Inventory Management: This can tie up valuable capital, increase storage costs, and lead to stockouts or obsolete inventory, further impacting your cash flow.

To improve budgeting and cash flow management while also curtailing financial duress, several practical tips can be implemented (most of which can be streamlined using business and eCommerce accounting software tools).

- Regularly review and update your budgets to ensure they reflect changing market conditions and business needs.

- Consistently track and categorize expenses and revenue sources to gain better visibility into your financial performance.

- Set realistic revenue goals based on thorough market research and conservative estimates.

- Build an emergency fund in case you need a safety net. Worst case scenario, you don’t need it and can reinvest that money down the line.

- Optimize inventory management through efficient practices like just-in-time ordering and demand monitoring helps minimize excess stock and associated costs.

Additionally, exploring cash flow solutions such as working capital loans or flexible payment terms can help bridge gaps and support growth. By implementing these strategies, you can enhance your budgeting and cash flow management, bolster your financial stability, and position your eCommerce business for long-term success.

2. Relying on a Single Stream of Revenue

We recognize that this one isn’t always the easiest to correct, but relying solely on one income source is a risky move for eCommerce sellers. Diversifying your revenue streams is incredibly important. You needn’t look any further than the global Covid shutdown (and the repercussions it had on businesses) to understand that multiple means of income can make the difference between success and destitution.

Setting up multiple income sources helps distribute risk across different market segments, products, and/or services. If one revenue stream faces challenges, other streams can help compensate and maintain overall financial stability while you try to correct the source that is failing.

It’s really no different than parents choosing to invest their money in stocks and real estate in case they lose their job and need to support their kids’ livelihood. When it comes to your livelihood, keep the dice for the craps tables.

Another advantage of doing this is that you can more readily adapt to changing market conditions, consumer preferences, and emerging trends. And the best time to look into expanding your sources of income (believe it or not) is when your eCommerce business is flourishing.

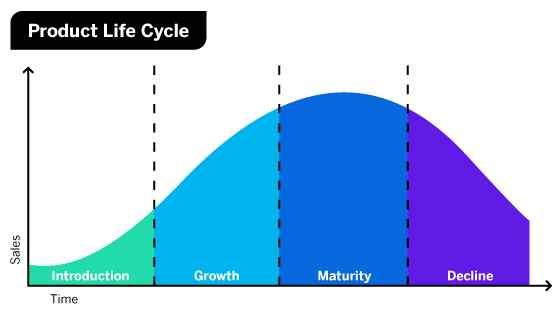

Have you heard of the product lifecycle? If not, now is a good time to learn.

What is the Product Lifecycle?

As the graph above indicates, the product lifecycle encompasses the entire lifespan of a product – from its initial launch to its saturation, maturity, and eventual decline in sales and popularity.

This is how it works. Let’s say you get a patent on a unique style of drink tumblers that retain heat and ice better than anything else on the market. You then launch that product online (Introduction). People get word of this new type of drinking tumbler and you invest a lot of money into marketing (Growth). Once you’ve created enough awareness about your tumbler and have accumulated a lot of great reviews, the tumblers start selling themselves (Maturity or Saturation).

It’s at this point that many eCommerce sellers make the mistake of riding the coattails of their good fortune; they assume that their product will always be successful. But that’s not how the consumer market works. Either someone will come up with an even better design than yours or the market will become saturated with knock-off brands that are similar to your product. Either way, the popularity of your tumbler will eventually decline (as indicated in the downward curve of the above graph).

What experts recommend is that you create a new product when your original product is in the maturity stage of the lifecycle. That way, you can reinvest the money you are making from your first product into your second product and have dual streams of revenue coming in.

Other Ways for eCommerce Sellers to Diversify Their Revenue Stream

The good news is that in today’s technology-driven landscape, eCommerce sellers have numerous options to expand their financial portfolio. Here are some options you may want to explore:

- Selling Complementary Products: Offer accessories that complement your existing offerings. If you sell on Amazon, you can even sell your products in bundles to both upsell and maximize the value of your products.

- Affiliate/Influencer Marketing: Partner with other businesses and earn commissions by promoting their products or services on your eCommerce platform. Not only can you make money on the side through affiliate programs, but cross-promotion means a larger audience – sans marketing costs.

- Sponsored Content or Advertising: Collaborate with brands and feature sponsored content or advertisements on your website or social media channels to generate additional revenue.

- Licensing or White Labeling: Explore opportunities to license your brand, products, or intellectual property to other businesses or consider white labeling your products for other retailers to sell.

It’s important to note that these are just a few examples of ways to bring in more streams of revenue. There is a plethora of other options available to you – you just need to do the research.

3. Insufficient Customer Retention and Repeat Business

In the highly competitive world of eCommerce, retaining customers and fostering repeat business is essential for long-term financial success. Many online sellers focus heavily on acquiring new customers yet fail to prioritize customer retention. This is a costly mistake.

- Acquiring a new customer costs roughly 5x more than retaining an existing customer.

- By increasing customer retention by 5%, you can increase profits margins by at least 25%.

- The success rate of selling to a customer you already have is 60-70%, while the success rate of selling to a new customer is 5-20%.

- Loyal customers are 5x as likely to repurchase, 5x as likely to forgive, 4x as likely to refer, and 7x as likely to try a new offering.

- U.S. companies collectively lose about $136.8 billion per year through customer attrition.

To avoid losing customers, it's crucial that you invest in strategies that nurture customer loyalty and encourage repeat purchases. Building strong relationships with your clientele, as well as providing an exceptional post-purchase experience for your customers, helps foster brand loyalty.

According to Tim Halloran, writer of Romancing the Brand: How Brands Create Strong, Intimate Relationships with Consumers, effective marketing must create a meaningful and emotional connection between the brand and the consumer. “[Sellers] must keep the sparks alive in a long-term relationship rather than focusing solely on the short-term, single purchase,” Holloran explains.

There are many ways for you to nurture a long-term relationship with your customers, but one of the most effective strategies is to implement a customer loyalty program. By doing this, you can offer rewards, discounts, or exclusive perks to existing customers that (hopefully) will incentivize them to continue buying from your online store.

That takes care of the perceived monetary value that your customers feel they are capitalizing on, but what about the emotional connection to your brand?

This is when understanding your target audience and taking advantage of innovative marketing tools can lead to brand loyalty.

SaaS tools, customer analytics, campaign automations, and bots can effectively personalize communication and tailor offers to individual preferences, which in turn can significantly enhance the customer experience and make your customers feel “seen.” A customer that feels seen, feels special. That creates an emotional connection with your brand that nurtures client loyalty and retention.

Ultimately, prioritizing customer retention and fostering repeat business is a proactive strategy that helps eCommerce sellers maintain a stable revenue stream that reduces the reliance on new customer acquisition. By investing in exceptional customer service, implementing loyalty programs, and personalizing the customer experience, you can establish a strong foundation for long-term financial success in the eCommerce landscape.

4. Forgoing Business Insurance

This happens all too often, and to be fair, we understand why it happens. Online sellers usually invest such large amounts of money into creating, launching, and marketing their business that it’s tempting to cut financial corners wherever possible.

The problem with this mentality when it comes to insurance is that it’s only a cheaper option if:

- You are never sued

- You never lose inventory

- You never experience a cyber attack

- You never have a defective product

- You never have an injured employee

- You never have to deal with natural disasters, theft, fire, or flooding

- You never have to experience business interruption... the list goes on.

Now, to be fair, none of us at Ashlin Hadden Insurance are fortune tellers. Maybe you’ll be one of those “unicorn” business owners that never experiences any business perils. However, the chances of you being that lucky are about as slim as my chance at being able to be a fortune teller.

What does insurance have to do with financial risk?

Let’s say your company is sued and you don’t have liability insurance.

Best case scenario: You win but you still have to pay lawyer and court fees.

Worst case scenario: You are found responsible and could owe so much in damages that you lose your assets and business.

Neither of those situations makes for smart business practices.

General Liability Insurance

If you sell on Amazon and make over $10K a month in revenue, then you are aware that you have to have liability coverage.

A general liability claim refers to a legal action by a customer or third-party who experienced mental, emotional, physical, or financial injury as a result of doing business with your company.

General liability insurance provides coverage for the costs associated with defending against such claims such as legal fees, medical bills, settlements, or judgments. This type of policy also extends to any property damage, as well as any claims of slander, libel, or copyright infringement made against your company.

EXAMPLE OF NEEDING GENERAL LIABILITY INSURANCE:

Imagine you run an online store that sells health supplements and nutritional products. As part of your marketing strategy, you hire models to take “before” and “after” photos that insinuate your models used your supplements to transform their looks (when in reality, they did not).

Now, say one of your customers finds that your supplement did not deliver the promised results, and believes the before-and-after photos were misleading. Feeling deceived by your false advertising claims, he decides to take legal action against your business, alleging false advertising and seeking compensation.

General liability insurance (depending on the specifics of your policy) would likely cover most (if not all) legal defense costs and settlements/judgements should you be found guilty.

Product Liability Insurance

Many people confuse general liability claims with product liability claims, but there is a distinct difference between them. As mentioned above, general liability is when your business, employees, or operations injure a customer or their property. Product liability is when your products injure a customer or their property. This is usually due to a manufacturing or design error.

Product liability insurance works similarly to general liability insurance in that it helps cover medical, legal, and settlement/judgement costs.

Product insurance coverage is really important for businesses that sell products, regardless of how innocuous you deem your items to be.

EXAMPLE OF NEEDING PRODUCT LIABILITY INSURANCE:

Let’s say your online business sells soft plush toys marketed as safe and suitable for young children. The toys are made of high-quality materials and have undergone rigorous safety testing according to industry standards. Parents trust that these toys are harmless and perfect for their kids.

Unbeknownst to you, a small percentage of your plush toys were assembled with a manufacturing defect that leads to the button eyes popping off. One of your customers has a toddler who accidentally pulls off the button eye and swallows it, requiring immediate medical attention.

In this situation, the seemingly safe plush toy has caused bodily (and possibly psychological) harm. More than likely, the customer would sue and win. If you didn’t have product liability insurance, you would be on the hook for the medical, attorney, and settlement fees.

Product Recall Insurance

Piggybacking off the last example, let’s say that the U.S. Consumer Product Safety Commission recalled the button eyes that you use for your plushies because they were confirmed to be choking hazards on many other products. Even if there were no other defects found with your plush animals, you would still have to:

- Discontinue your manufacturing orders.

- Pull your inventory from all your warehouses and dispose of it.

- Contact and refund any customer that has ever purchased the plushies with the recalled button eyes.

Not a cheap feat. Product recall insurance can man the costs for all those processes.

Conclusion

In a smoke-and-mirrors society where online entrepreneurs project their revenue into the limelight and not their profits - be the opposite.

It doesn’t matter if your business brings in a revenue over $50K a month if one or more of these things are happening:

1) You’re not budgeting your expenses properly.

2) Your business and personal costs exceed $50K a month and your only income stream is from your business.

3) You are losing clientele and repeat customers.

4) You get sued and don’t have proper insurance to cover the costs

By taking some of the advice in this blog and even speaking to a financial advisor, that $50K revenue could become $50K profit.

About Ashlin Hadden Insurance:

Ashlin Hadden Insurance is a brokerage agency that specializes in helping Amazon, Walmart, & eCommerce sellers protect their business, finances, and assets. We work with over 50 premium insurance carriers that we’ve vetted to ensure that you are getting the full protection you deserve.

To get a FREE QUOTE and find out what insurance policies are the right choice for your business, fill out our 10-minute application.

About the Author:

McClain Warren is the Brand Ambassador and Marketing Director for Ashlin Hadden Insurance – an eCommerce-focused insurance brokerage agency that helps protect Amazon, Walmart, and other eCom businesses.

Getting started in days.

Ready to simplify your accounting? Schedule a call with our team and explore your options. We’d love to hear from you!